Complaining about how much easier past generations had it—no smartphones to distract us, no high-fructose corn syrup to poison us—is a beloved pastime. But when it comes to buying a home in San Diego, little has changed.

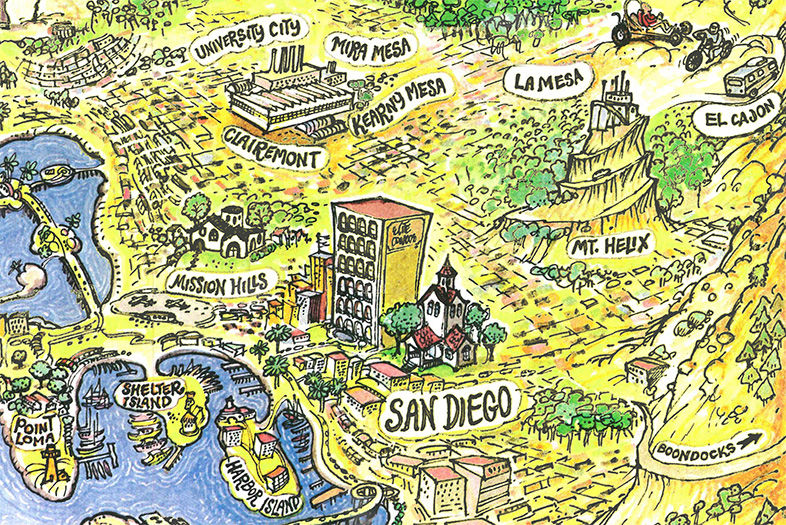

In a 1977 San Diego Magazine article titled “Are You Living Where You Should?” writer Bill Ritter examines the county’s housing market in the era of disco and Jimmy Carter—and some of his takeaways sound awfully familiar.

“Despite the wide variety [of home styles], there is not a limitless supply of either homes or land to build on them,” he writes. “And the situation can only get tighter as more and more people from across the country and in other parts of California eye San Diego’s excellent climate and aesthetically pleasing topography.”

New residential building permits were down 20 percent in 2017, according to the Building Industry Association of San Diego County. And just like our real estate experts say about our current milieu, the mantra even then was “Buy now!”

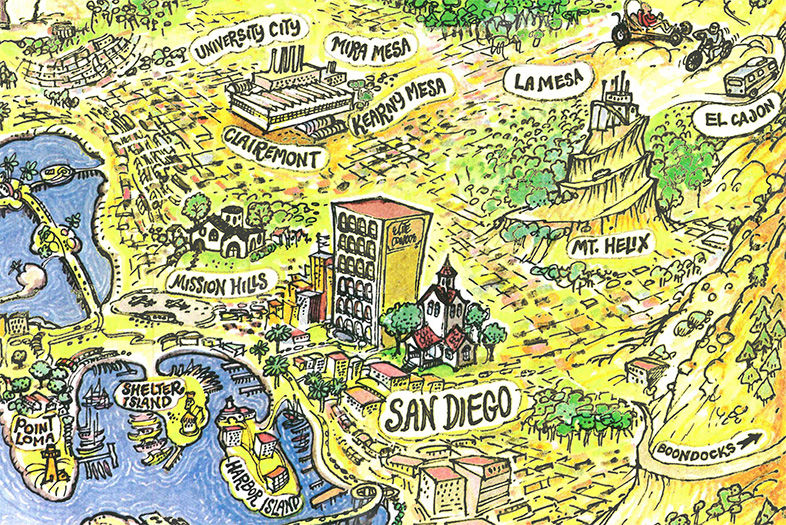

In his piece, Ritter scans for the top real estate pockets. He suggests buying in “older sections,” like Mission Hills and Hillcrest, that off er “urban life in a near-rural setting.” Back then, houses in those neighborhoods averaged $68,000 and $40,000, respectively. Now? Try million-dollar price tags.

As has always been the case, living by the beach will cost you. In 1977 La Jolla, the average price for a new home was $120,000, while moving inland to Clairemont and Tierrasanta dramatically dropped prices to about $40,000.

Ritter goes on to claim that South Bay is “where the action is,” citing that in early 1976, 16 developments went from selling 24 to nearly 50 units per week. Today, the trend continues; all eyes are on Otay Mesa’s new Millenia development, with apartments, for-sale homes, 80 walkable city blocks, restaurants, shops, and more.

What also caught our eye from Ritter’s reporting were the reasons for the ’70s housing market shift. For starters, only 15 percent of San Diegans were able to afford a home on one salary, so more women had to enter the workforce, which “changed the home buying picture.” Then there’s the reason nearly every generation can attest to: a tight economy. In 1977, nearly 75 percent of American families couldn’t afford to buy a new home. Today, more than 38 million American households can’t afford their housing, an increase of 146 percent in the past 16 years, according to a 2017 Harvard University study. It’s no wonder the title of this article was a question—one we continue to ask 30 years later.

From the Archives: San Diego’s Real Estate Market in 1977